life daily

now, after two tax duty-free camps have been added to the preferential

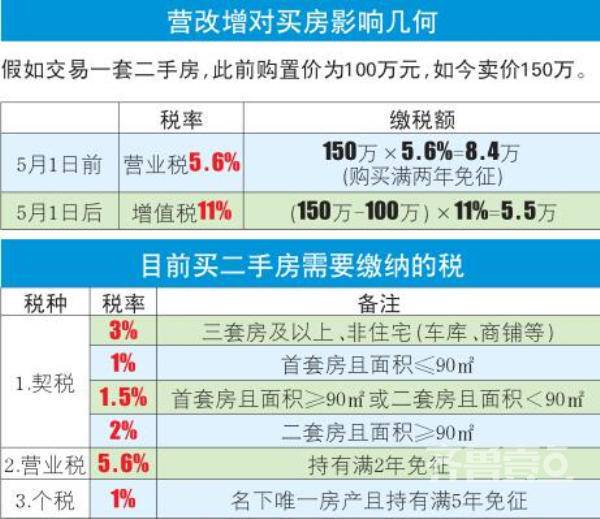

now, after two tax duty-free camps have been added to the preferential the Ji'nan citizens, Mr. Gao is considering changing the house, preparation, preparation, preparation Buy a large second-hand house. In May, the camp changed to increase, and whether the tax was more or less? Now, when the intermediary recommends the housing source to him, he will take the certificate for two years as a key element. Because according to the current tax policy, the property certificate will be 5.6% years free of business tax (including additional tax). For a large family, this tax is not a decimal. Therefore, when choosing housing sources, Mr. Gao prefers to have a two year duty-free housing.

from May, business tax will be abolished and VAT changed. Mr. Gao said that according to his understanding, this is a tax on the value added part of the house. It is not possible to buy a house for only a few years. Whether the vat has been exempted for two years?

according to Wang Jun, director of the State Administration of Taxation during the two sessions of this year, the reform direction and intention of the camp is to reduce the tax burden. In March 18th, the official website of the Ministry of Finance issued a message on the principle of the original business tax preferential policy in the new pilot industries, and adopted the transitional measures for the old contracts, the old projects and the specific industries to ensure that the overall tax reduction of all industries and the tax burden of the vast majority of the enterprises were achieved. Reduce the policy effect. According to

, according to the insiders, after the second-hand housing trading camp has been changed to increase, the preferential policy which is exempt from two years' license is a big probability event.

housing reform room value added about a million tax burden whether the increase of

Mr. Gao said that he is now living in the housing reform room, that year, the housing reform spent tens of thousands of pieces, because the lot is good, now the words at the minimum can be worth about 1000000. If I pay taxes according to the value added tax, is not my house the most vulnerable? And because of historical problems, his house has lived for more than 20 years, but just got the property certificate.

an intermediary director in Ji'nan said that in actual transactions, some houses may be affected. Mr. Gao, such as Mr. Gao, has often met with a house property certificate for several decades. The Ji'nan land tax department is allowed to use a unified purchase receipt in the year to prove the actual holding time in order to achieve the reduction and exemptions when the housing reform house of the new certificate is levied. But it is not known how to do it after VAT is changed. If it is taxed according to the 11% VAT rate of the real estate industry, it must be a big expenditure.

housing prices in Ji'nan have been growing steadily. The greater the age of housing, the greater the value of housing. If we only pay tax on the value-added part, we will not consider the factors of holding years of reduction and exemption, which will be a bad thing for the old house. According to past experience, personal property transactions tax burden increases, landlords will inevitably raise prices to pass on to buyers. The person in charge said that if there was no value-added tax for two years, there would be no such problem.

the price of the net signed or the citizens who will be ready to sell at the loss of

to see the news of the increase, it is hard to cry: my house does not see the transaction price of 400 thousand, but it cost 700 thousand. A few years ago, in order to pay less taxes, deliberately lower the number when signing the net. If you pay taxes according to the value added, you will lose money if you change hands. A virtual increase of 300 thousand!

an intermediary trader Lee revealed that at present for the provincial tax, second-hand housing buyers and sellers in the net time intention to lower the transaction price is not a secret. I just completed one last week, a second-hand housing in Lixia District, the actual transaction price of about 1200000, but when the net signed, the two sides agreed to fill in 800 thousand. Because the tax is based on the net price, which can help buyers pay less taxes, including deed tax, even personal tax and business tax.

camp changed to increase, this phenomenon was changed. Second hand housing sales no invoice, the tax department to calculate the value of the property, how much is likely to be quoted by the online signature system. When buying a house, the price will be lowered, and the value added will be increased by hundreds of thousands of dollars in the future sale. The value added tax will be paid at the rate of 11%. It has saved thousands of dollars in taxes, and it may add tens of thousands of dollars in taxes. Falsely reporting the price of the net sign will lose its meaning and even lose the gain.

Ji'nan second-hand housing market has not yet been significantly fluctuating

five new countries in 2013, rumored that the transfer of second-hand housing transfer by 20% of the value of individual income tax, tax speculation set off a wave of transaction climax in the short term, Ji'nan second-hand housing market suddenly burst. With the subsequent rule of panic disappearing, the market returned to calm. This camp to increase, will copy the 20% tax market?

20, reporters from the chain, twenty-first Century and many other intermediaries learned, although it has been set to start to increase in May, but the second-hand housing market has not seen significant fluctuations. At present, the tax and fee expenditure of second-hand house sale is generally borne by the buyer. Therefore, it has little influence on the owner. As for the impact on the buyer, the specific policy rules and specific operations should be seen. Everything is in a state of uncertainty, neither buyer nor seller is worried. Ji'nan chain family staff said that some customers have hurried to transfer their business to avoid the long night dream and prevent policy changes.

the industry believes that the value of VAT according to the actual increment is more fair and reasonable compared to the previous sales tax on the price and the holding period, and much more tax is made in the transaction. It will be beneficial to the transaction and circulation of second-hand housing.